After years of justified frustration from taxpayers, state lawmakers have finally decided to address South Carolina’s highest-in-the-Southeast top income tax rate. The House on Wednesday passed a bill that would lower and consolidate the state income tax, while the Senate recently introduced its own income tax proposal that includes a plan to use $1 billion in surplus funds to pay for a future tax rebate.

Despite a shared objective, the bills take different approaches to lowering the income tax. Critically, the proposed top rate of 6% under the House bill is not guaranteed, rather it would be phased in over multiple years on the condition that state revenue continues to grow.

Below is an analysis comparing the two proposals.

.

The House plan

In its first year, the House tax plan would lower the top income tax rate from 7% to 6.5% and consolidate the lower tax bracket (4%, 5%, 6%) down to 3%. After that, the top rate would be reduced by .1% each year until reaching its target of 6% if revenue growth for the next fiscal year is deemed sufficient.

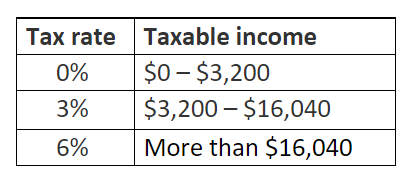

Current tax bracket (2022)

Simplified House bracket (after full implementation)

The revenue requirement

Under the House bill, state economists would need to estimate at least a 5% increase in anticipated General Fund revenue for five consecutive years for the cut to fully phase in by 2027. If this revenue requirement is not met, the .1% tax reduction would be delayed until the next year in which at least a 5% revenue increase is projected. Under this provision, it is possible that multiple consecutive years could pass during which taxpayers never see a tax cut.

For context, the revenue growth rate in FY 21-22 according to the S.C. Revenue and Fiscal Affairs Office was only 2.54%, a number that would fail to satisfy the revenue requirement imposed by the bill.

This requirement, or another like it, should not be part of the deal for taxpayers. State government is projected to have an unprecedented $4.6 billion extra to spend for the upcoming fiscal year. If lawmakers opt for the House plan, that additional revenue should be used to cut the top rate to 6% in year one.

According to state economists, General Fund revenue would be reduced by slightly more than $1 billion per year after the House income tax cut is fully implemented. Put differently, the $4.6 billion surplus is enough to cover the cost of the entire income tax cut for four years with money to spare.

Year one vs. full implementation

How much difference can .5% make? A lot, as it turns out. We ran two scenarios comparing the tax liabilities for hypothetical taxpayers based on the proposed House tax cut, one using the initial top rate of 6.5% and another using the final rate of 6%.

- A single filer making $50,000 would save about $100 more on his/her state income taxes if the cut were fully implemented in year one

- A married couple filing together with two children making $100,000 would save about $250 more on their state income taxes if the cut were fully implemented in year one

*Scenarios based on tax year 2022; amounts factor in relevant deductions but not tax credits or reductions to adjusted gross income

These amounts would represent meaningful savings for taxpayers. We recognize, of course, that the first year of the cut would already lower taxes – a policy long overdue. But to delay full relief, leaving it in the hands of an unknown future economy, is a risky and unnecessary decision if the deal can be paid for up front.

The Senate plan

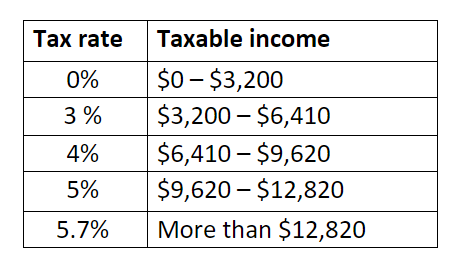

Conversley, the Senate income tax cut would be fully implemented in year one. The top income tax rate would drop from %7 to %5.7, while the lower bracket would be taxed at %3, %4 and 5% depending on income.

Simplified Senate bracket (effective year one)

Comparing the House & Senate brackets

The proposed House bracket appears to be favorable for lower earners whose taxable income mostly falls under $16,040, as this income would be taxed at just 3% (excluding income under $3,200, which wouldn’t be taxed at all). Of course, higher earners would also see a tax cut, though the reduction would feel more significant as the top rate inches closer to its target of 6%.

The Senate bracket is a bit more complicated. While the top rate would immediately drop to 5.7%, it kicks in at a lesser income than the House bill, starting at $12,820. That means people would be paying the top rate sooner. For middle to higher earners who have most of their income taxed at the highest rate anyways, the rate itself is more important, therefore the Senate bill could be favorable.

Senate tax rebate and other changes

Most notably, the Senate bill would use $1 billion in surplus funds to pay for a one-time tax rebate for state residents. The bill does not specify if payments would be equal across the board or if those who paid more in taxes would get more back, leaving the details to be worked out by lawmakers in future legislation.

The Senate bill would also significantly increase the property tax exempti0n applied to manufacturing property. Under state law, the exemption does not apply to property owned or leased by a public utility that is regulated by the Public Service Commission.

Finally, both bills would allow veterans to deduct all their military retirement income from their taxes (current law allows for some but not all).

***

We will continue to track these bills and give updates as they move through the legislative process. To learn more about other critical tax reforms not addressed here, read our tax report published last month.

[…] we published our analysis comparing the House and Senate tax cut bills last month, we noted that state government was […]

[…] Update as of 4/29/22: The Senate passed its version of the budget Thursday. No changes were made to its tax relief plan, which includes setting aside $1 billion in recurring revenue to lower taxes (specifically $886 million to cut the state income tax) and $1 billion in nonrecurring revenue to pay for one-time tax rebates. Read more about the plan here. […]