While the 2021 regular legislative session ends this week, lawmakers are set to return to Columbia in June – possibly on three separate occasions – to address a number of matters as allowed per the end-of-session rules, or “sine die” resolution. The most immediate of these legislative responsibilities is passing the state budget, as the next fiscal year begins July 1.

.

What’s in the budget?

Last month, Senate lawmakers passed a state appropriations bill of $31.8 billion – a noticeable increase over the House version totaling $31.1 billion – mostly due to a higher revenue projection by state economists. This updated budget forecast has led the House to nearly restart its budget-writing process, holding a number of budget subcommittees (typically held early in the year) during the final week of session, with more committee meetings scheduled in the coming weeks.

As the Senate budget is most current, it will be the version primarily discussed here.

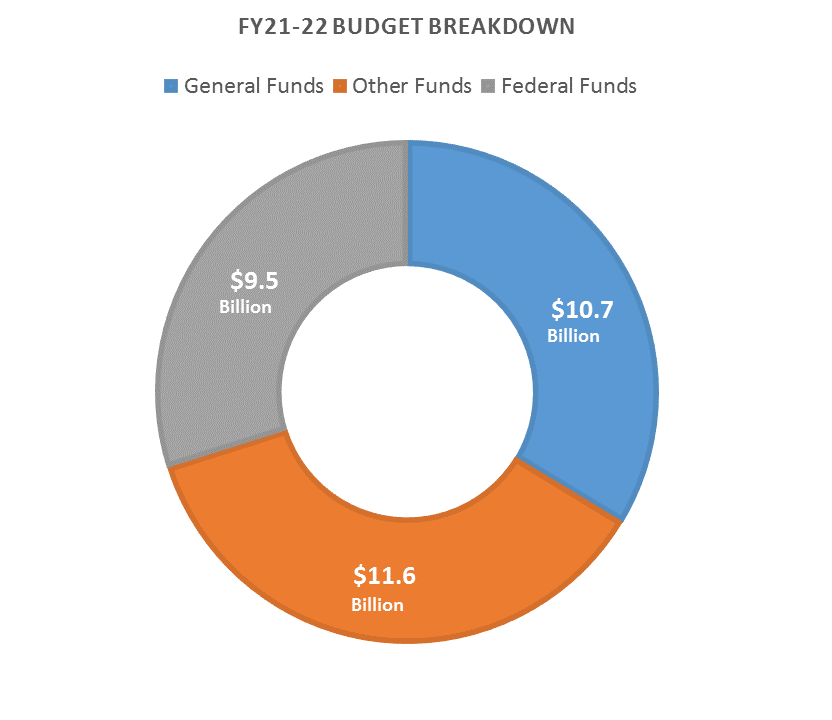

There are three main categories of spending under the state budget

- General funds are comprised of tax revenue and is the only category of state spending debated by lawmakers. The Senate’s proposed general fund is $10.7 billion.

- Other funds are the revenue generated primarily from fines and fees and other dedicated revenue sources – such as the gas tax, which lawmakers renamed a “fee” and which state law allocated to the Department of Transportation. The latest other funds spending would total $11.6 billion.

- Federal funds are as they sound – dollars received from the federal government. These dollars are not free, however. Nearly all federal funds come with strings attached, including program matching requirements, mandates for future state spending, and various other policies that South Carolina must adhere to in order to get funding. Federal funds under the budget total $9.5 billion.

It’s important to note that the budget process is not carried out in a way that examines current spending practices. When agencies submit their budget requests each year, for example, they only include requested changes to last year’s funding, instead of justifying their total spending as required by law.

“It is the intent of this section that each state agency, department or institution shall be required to justify its recurring expenses, as well as any new or additional expenses.” [Section 2-7-65 of the S.C. code of laws]

Instead, the only real discussion that takes place on the budget is how new and leftover money will be spent, of which there is roughly $1.8 billion for next fiscal year (a combination of roughly $520 million in recurring funds and 1.3 billion in non-recurring funds).

Here’s a look at some of those spending items:

Employee benefits

- Base pay increase of 2% for state employees – $47,633,554

- Health insurance increase – $14,643,200

- State retirement contribution increase – $32,411,836

Education

- $1,000 teacher salary increase – $72,063,180

- School resource officers – $12,000,000

- Bus driver raises – $4,181,714

- Capital funding for disadvantaged schools – $100,000,000

Higher education

- Tuition mitigation – $38,066,709 (total among all colleges, universities and technical schools)

*While these funds are intended to keep schools from raising their tuition rates, lawmakers removed the budget proviso that blocked them from doing so. Without the proviso, there technically isn’t anything stopping schools from raising their tuition.

Economic Development

- LocateSC – $4,000,000 (The Nerve wrote about this program here)

- PGA Championship 2021 sponsorship – $360,000

- Destination specific tourism grants (The Nerve wrote about this program here)

- $15,000,000 (one-time funds from state surplus)

- $14,000,000 (the amount appropriated in previous years*)

- Program total – $29,000,000

- Tourism advertising – $5,000,000

- SC Film Commission – $15,000,000

Judicial

- Case management system modernization – $1,000,000

- Digital Court reporter project – $1,925,000

- Drug court funding – $1,600,000

- Illegal immigration unit– $763,222

- Body cameras – $2,000,000

- PTSD treatment – $250,000

Corrections

- Law enforcement, correctional officers and medical staff retention – $8,753,123

Juvenile correction officers retention – $4,565,582 - Hiring full-time in-house nurses – $4,000,000

- Medical supplies and equipment – $5,000,000

.

Budget provisos

In addition to appropriating funds, every state budget contains a section of year-long directives called provisos. These provisos (contained in Part 1B of the budget) should merely explain the line-item spending in Part 1A, but have become a catch-all of a wide assortment of legislative purposes.

Below are some of the more notable budget provisos.

.

117.153 – Fewer checks on higher education spending. Under this proviso, the state’s largest universities (University of South Carolina-Columbia, Clemson and the Medical University of South Carolina) would be exempt from traditional approval and review requirements for a range of projects if they cost less than $5 million. Projects by smaller universities and tech schools would enjoy the same exemptions if they cost less than $2 million. It should be noted that lawmakers have been trying pass a similar version of this policy as a bill for years, which alone should suggest it does not belong in the state budget.

*This proviso is in both the House and Senate versions of the budget

.

117.22 – Restrictions on using state-owned aircraft. This proviso, as amended, would prohibit a member of the General Assembly from flying on a state-owned plane unless the flight is initiated by a cabinet agency, or the lawmaker receives permission from either the House speaker or Senate president, as appropriate. South Carolina officials have a long history of using the state-owned planes for questionable purposes (which is discussed further here and here), however such matters are better addressed through traditional legislation, not the state budget.

*This proviso change is only in the Senate version of the budget

.

49.18 – Reduction/removal of match requirement for tourism funds. Per this proviso, the Department of Parks, Recreation and Tourism (PRT) would fully waive the private match requirements normally needed to receive Destination Specific Tourism Marketing Grants, if they were paid from non-recurring funds. The PRT director could also reduce matching requirements for grants funded with recurring funds at their discretion. (Read more about this here)

*This proviso is in both the House and Senate versions of the budget

.

42.6 – Creating a housing shortage study committee. This would create a committee, appointed entirely by lawmakers, to study the “housing shortage’s effect on affordable housing in the state”. It goes without saying that this proviso is unrelated to appropriating funds, and therefore should not be in the budget.

*This proviso is only in the Senate version of the budget

.

47.15 – State purchase of invasive lizards. This would direct the Department of Natural Resources to spend up to $100,000 to create a program to encourage the surrender of Black and White Tegus, an invasive lizard species from South America. Residents would receive $100 for each lizard handed over to the department.

* This proviso is only in the Senate version of the budget.