The most important bill passed in each legislative session is the state budget. Every year, state agencies spend more and more taxpayer dollars on a variety of things – sometimes actual core functions of government, but too often on pork, pet projects, and non-essential items like tourism, marketing and politically driven economic development.

Worse, the budget and the budget process are characterized by nontransparency – from the unaccountable way in which the budget comes together (a process which violates state law) to the failure to fully debate and disclose various aspects of state spending, to the layers of secrecy shielding recipients of lawmakers’ largess, to the lack of accountability to ensure those dollars are spent as were directed.

One particularly egregious example of poor transparency? The House and the Senate chambers failed to submit their budget requests at all, despite being funded through the budget (and in fact receiving budget increases last year) and sitting on large funding reserves. As a result, citizens have no idea how much lawmakers want to spend for themselves this year.

With the legislative session right around the corner and the budget process in full swing, here’s a look at the taxpayer dollars the various state agencies want to spend in the next fiscal year, and whether these requests complied with the budget law.

Did the executive branch follow the budget law?

According to state law, the budget process starts with the executive branch. The Governor is required to survey the state agencies and collect their zero-based budget requests along with detailed information about each requested appropriation, including:

- How much each agency is asking for, in itemized form

- The agency’s reasoning for why it should receive the requested funding – both recurring and new expenses

- How much federal funding the agency is getting and what strings are attached

- Where the agency’s Other Funds (fines, fees, etc.) are coming from

- The purpose, goals, and quantitative measurements for every program the agency provides

State law holds the Governor responsible for full compliance with this requirement of law. It’s his job to design the forms the agencies use, and the information is submitted to him.

Unfortunately, the published budget requests are nowhere near compliant with the statutory requirements. Instead of listing the entire amount the agencies want to spend, they simply list desired changes to last year’s spending. The agencies, accordingly, only explain why they should receive the additional funds requested, instead of why they should again receive what they were allocated last year.

The federal funds disclosure requirements are violated as well. Any information the agencies provide is for additional federal funds requests, and even then the explanatory information is typically incomplete when compared to what the law requires.

Big Spenders

Economic forecasters are predicting a whopping $1.8 billion in new available revenue for lawmakers to spend next fiscal year, and many state agencies are asking for extremely generous budget increases. Among the biggest spenders are the following agencies, which all asked for nine-figure increases over last year’s spending.

The Department of Education – $774 million

Department of Education is asking for a $774 million total budget increase – over and above last year’s budget of $5 billion. $100 million of the new funds is a federal aid increase for various unspecified federal grants. The department is also asking for a recurring $164 million increase to teacher salaries and a $92 million increase in student funding, as well as $150 million of one-time surplus dollars for school district consolidation (and facilities upgrades for those districts).

Department of Health and Human Services (DHHS) – $650 million

This funding increase – all of which is for Medicaid-related expenditures – would bring the Department’s budget up to $8.4 billion. $52 million of this request is for the Children’s Health Insurance Program (CHIP) due to “decreased federal participation,” as the federal government’s funding for this program will drop by 20% in 2021.

Higher education – $603 million

South Carolina’s public colleges and universities are collectively asking for budget increases totaling over half a billion dollars. Of these Clemson University, the entire University of South Carolina system and the Medical University of South Carolina each asked for nine-figure budget increases.

For perspective, lawmakers awarded $4.5 billion to higher education in the previous year – fifteen percent of the entire state budget. This budget request would bring the total higher education appropriation to over $5 billion.

Additionally, the State Board for Technical Education is asking for an additional $316 million for the technical college system.

Here are some highlights from the college/university funding requests:

Tuition mitigation funding – several institutions, along with the Commission on Higher Education (CHE), want more funding in exchange for freezing tuition hikes – or at least slowing them. Lawmakers increased college/university appropriations last year on the condition of a “soft” in-state tuition freeze with a number of loopholes built in. The CHE’s tuition mitigation request, notably, would close some of those loopholes.

“While the State has provided additional state appropriations in recent years, and Clemson is appreciative, the University’s current E&G recurring state funding is still $17.7 million less than FY 2007-08 funding levels.”

– Clemson University

“Our state needs 70,000 additional baccalaureate degree holders above current graduation rates to meet the needs of business and industry by 2030.”

UofSC (emphasis added)

Buildings (construction, renovation, and deferred maintenance) – Most of the higher education budget requests contained funding for construction, renovation and deferred maintenance. For instance, Clemson is asking for $25.5 million for “a portfolio of smaller projects that would not necessarily be considered capital projects”. These have been budgeted for, although the university board has not approved the projects.

Similarly, UofSC wants $14 million for “critical maintenance needs,” although this expenditure has received board approval, and is not included in the university’s comprehensive permanent improvement plan. No explanation for the latter omission is given, although the agency submission guidelines require one if an agency asks for capital project funding that wasn’t in the 2019 CPIP submission. Nor does the request mention which buildings would actually be funded, although it does list significant buildings “that require capital renewal” and particularly mentions the desired renovation and upfit of Horry-Guignard House.

UofSC is also asking for $35 million to relocate their School of Medicine, and states that this project will create 2,000 construction jobs, 2,200-2,600 jobs for operation, and 950-1,200 jobs through “research, commercialization, start-ups and clinical services” with an estimated annual economic impact of $180 million and up to $9 million in tax revenue. No sources for these numbers are cited, nor are any background assumptions given.

Finally, Coastal Carolina University wants $23.5 million to build a new student union annex. According to the budget request, the new building will bring the university close to the Association of College Unions’ suggested average of 8.6 feet/student of space for student unions and activities.

Miscellaneous – Other higher education requests include:

- Personnel hires, raises, and benefits

- Meetings – the Commission on Higher Education (CHE) wants $35,000 in recurring dollars to fund at least two statewide meetings for both the Council of Presidents and a Council of Board Chairs, including venue and allowable meal charges, and travel costs for potential nationwide experts in higher education policy. The Commission will seek matching donations from university foundations to supplement the state meal plan rates.”

- Professor of the Year award – The CHE is asking for $15,000 to fund an awards program instituted in state law. Under this program, two professors (one from a college/university and one from a technical college) would be awarded $5,000 prizes, while ten $500 awards could be distributed among finalists. State law requires the CHE to ask for this appropriation, but the program has not been funded since fiscal year 2008-2009.

- Tuition assistance – the CHE is asking for $32,000,000 in non-recurring dollars for needs-based tuition grants

- Funding for the UofSC law library – In an apparent attempt to offload the law library’s cost of serving the public onto taxpayers, UofSC is asking for asking for a recurring $826,000 to cover the cost of serving the “bench, bar and public” rather than just students

Department of Mental Health – $163,098,513

The Department of Mental Health is asking for a total of $163 million for employee raises, mental health service programs, etc. However, $87 million of this requested funding would go to buildings and renovations.

Department of Social Services – $153,983,914

The embattled Department of Social Services is asking for an additional $154 million to fund reforms tied to the settlement of a class-action lawsuit filed in 2015. This budget increase would cover the hiring of 252 new positions, including caseworkers, program coordinators, statisticians, information technology specialists, etc., as well as a $35 million loss of federal funding due to decreased eligibility.

State employee hires, raises and benefits

Requests for new hires, raises, healthcare benefits and pension funding once again highlight the real cost of continual government growth. For context, lawmakers’ pension “reform” bill in 2017 required state agencies to increase their contribution to the state pension plan by 70% over a six-year period. It also should be noted that lawmakers appropriated $41 million last year for a 2% state employee raise, and another $20 million for employee bonuses.

One observable trend is the number of agency requests to transfer employees currently paid via Federal or Other Funds to the state payroll. This is just one of the ways federal funding can lead to future increases in state obligations.

Below are just a few examples of increased employee funding requests:

- Department of Children’s Advocacy – $2,600,000 for new staff and benefits (This department was created in 2018 as a consolidation of existing services in other agencies, and lawmakers claimed at the time that the new department would be able to operate on reallocated agency funds and would perhaps even enjoy cost savings – an unlikely event, SCPC observed at the time, based on South Carolina’s consistent pattern of increased agency budget spending.).

- Department of Health and Environmental Control – $5 million for raises for 52 positions, currently funded by federal or earmarked funds. These employees would now be paid from General Fund dollars.

- CHE – $85,000 for a data warehouse employee to oversee the migration of CHE’s management information system to the Department of Administration’s managed server platform, and once migrated, administer the database. (CHE also wants $350,000 in one-time funds to migrate the system. One of the listed benefits is “increasing CHE’s capacity to participate in the South Carolina Longitudinal Data System” – which appears to be the data warehouse initially created by state law.

- Judicial Department – $3.7 million to shift salaries of 63 employees (admin positions, direct support staff, court reporters/monitors) to General Funds (currently funded through court fines and fees – “an unstable source of funding.”). It should be noted that last year the Judicial Department requested – and received – a 33% pay hike for judges.

- Department of Juvenile Justice – $4.2 million for raises for 508 correctional officer positions and 304 community positions.

- Department of Labor, Licensing and Regulation – $2,180,000 for pension and health plan costs.

- The Department of Parks, Recreation and Tourism (PRT) is requesting a proviso amending their employee housing benefit for the State Park Service. Under this proviso, the housing cost would be added to the employees’ salaries, who would in turn rent the houses from PRT. This paycheck increase would increase the employees’ retirement contributions and eventual pension (as well as the PRT’s mandated employer contribution).

- Public Service Commission – $68,600 to cover “terminal leave” for up to three commissioners, and $500,000 for hiring new energy experts for the solar program.

- State Law Enforcement Division – $4,609,233 for 51 new positions consisting of special police task forces on terrorism, human trafficking, drugs and narcotics as well as technicians and administrative positions, plus $936,528 for promotions.

- State Library – $260,000 for four federal positions to become state-funded.

Economic Development

If these agencies get their way, the state will once again be funneling millions in taxpayer dollars into unaccountable and unnecessary programs. These include:

Department of Commerce:

- $3,700,000 recurring funds increase for the “Closing Fund”

- $250,000 recurring funds to operate the “Rural School District and Economic Development Closing Fund” – a fund of $65 million created by budget proviso last year

- $4,000,000 in non-recurring funds for Locate-SC. These funds would be sent to local government or “ally” groups to procure and prepare sites for potential prospects.

- $360,000 in non-recurring for PGA Championship 2021, to be used in conjunction with PRT’s funds for the same project

Department of Parks, Recreation and Tourism (PRT)

- $1,000,000 increase in recurring funds for commercials, some of which will feature Hootie and the Blowfish

- $2,000,000 increase in recurring funds for “Destination Marketing Organizations (e.g., Chambers of Commerce or Convention & Visitors Bureaus)”

- $1,100,000 increase in recurring funds that will go to eleven regional tourism organizations for marketing

- $360,000 in non-recurring funds for PGA Championship 2021 Kiawah Island

Department of Agriculture

- $400,000 increase in recurring funds for “market[ing] the Certified SC Grown brand and its products more aggressively, through additional television commercials.”

Higher education:

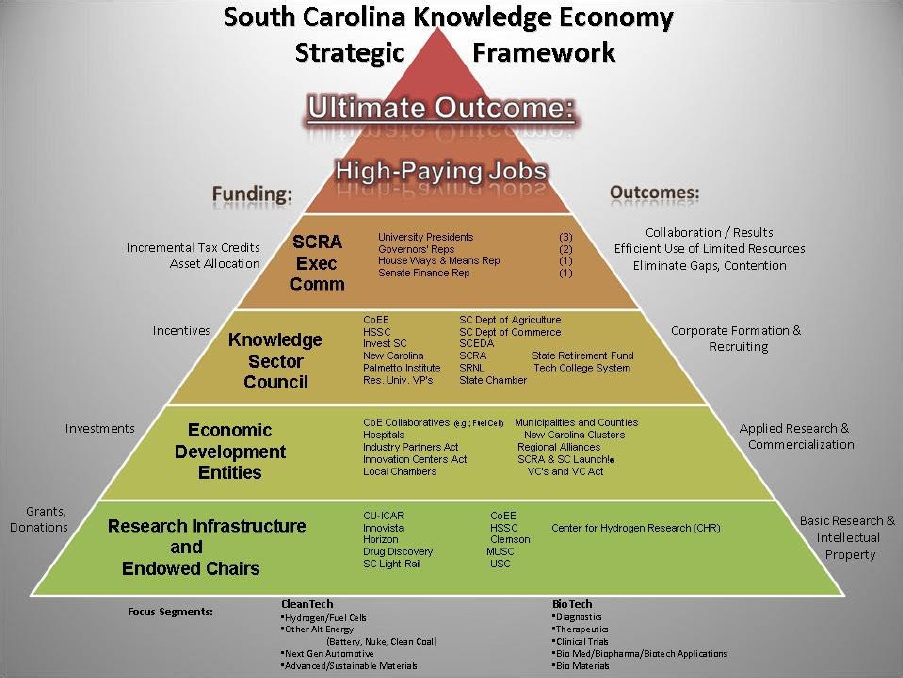

- The CHE is asking lawmakers to delete a budget proviso prohibiting them from spending money on marketing the SmartState program, which funds “Research Centers of Economic Excellence” at Clemson University, Medical University of South Carolina, and University of South Carolina. According to its website, the SmartState program “[brings] together its research universities and industry to fuel its knowledge-based economy” and is originally part of former House Speaker Bobby Harrell’s “knowledge economy” pyramid plan (see below). This program is funded through state lottery proceeds as well as private funds.

Provisos

Budget provisos should explain and elaborate on the funding directives in the state budget, but often are used for a wide assortment of legislative purposes, such as spending favors, new government programs or committees, and to pass failed bills. This practice often violates the constitutional one-subject requirement for bills.

Below are a few of the most significant budget provisos the state agencies are requesting:

- Clemson, UofSC and MUSC have all asked for two provisos making it easier for them to spend more with less state oversight. One proviso would lift the cap on permanent improvement projects that can be undertaken without multi-agency approval (including that of the CHE) from $1 million to $5 million for research universities, and from $1 million to $2M for all other colleges/universities. This is similar to provisions in the higher education “reform” bill which are designed to help major universities skirt oversight for major construction projects.

The other proviso would create a new “Higher Education Repair and Renovation Fund” to help pay for “renovation, repair, and related maintenance” for all 33 of the state’s public colleges – also similar to a provision in the higher education “reform” bill.

All three research universities reference that bill in their budget request, and UofSC specifically states that passage of that bill is their “top legislative and budget priority.” These provisos are an apparent attempt to bypass the proper legislative process – just in case it does not pass this year on its own merits.

- First Steps to School Readiness wants a new proviso allowing private child care centers that receive state or federal funding to participate in the state employee health plan, if they cover the entire cost of participation for their staff. This proviso would also allow these centers to purchase vehicles through state procurement contracts.

- DHHS is requesting a certificate of need (CON) exemption via proviso for any building project with the goal of providing better access to emergency medical services in communities where a hospital has closed in the past five years, or for “a previous hospital transformation initiative.” CON laws require medical providers to get government approval (a proof of “need”) before offering new medical services, purchasing certain medical equipment, or generally expanding the size of a healthcare facility.

- DOT wants a budget proviso allowing them to carry forward and spend all leftover and extra funds they accrue. This proviso appears to allow the agency to spend whatever federal funds and bond proceeds they have, whether those funds were part of the state budget or not.

- DOT is also asking for a proviso authorizing them to create a fee schedule for copies of records, lists, bidder’s proposals, plans, maps, etc. based on “approximate actual” costs of producing copies. It should be noted that state law already regulates the fees that state agencies may charge for responding to Freedom of Information Act requests, requiring that they be “reasonable,” cannot exceed the “actual cost” of retrieving the requested documents, and specifically, cannot exceed the hourly salary of the lowest-paid employee who could fulfill the request.

This proviso is not only unnecessary, but could open the door for DOT to charge unreasonable fees for answering citizens’ transparency requests. - Finally, the DOT is requesting a proviso stating that DOT employees are included in any employee raises, health insurance and bonuses given to state employees and funded by the General Fund. According to their budget request, DOT employees are not included in the general funding for across-the-board employee pay raises, and DOT “must therefore use funds planned for maintenance of state roads.”

Legitimate priorities

In contrast with the numerous, lavish spending requests for non-core government functions, several state agencies which provide necessary services to the public (and are often routinely underfunded) have requested funds for legitimate priorities.

For instance, the notoriously underfunded and understaffed Department of Corrections is asking for $40 million to replace locks and cell doors, and $15 million to simply start the process of replacing fire alarms that are not only out of code, but are so outdated that “the parts to repair and renovate the systems are no longer available.” Last year, lawmakers only appropriated $10 million for detention services and equipment upgrades, despite the department’s request for $159 million for these items.

Another example of a necessary government function is the Commission on Indigent Defense, which is asking for $15.4 million to increase the number of public defenders, support staff, investigators, etc., and to enable Circuit Public Defender Offices to hire additional attorneys to meet increasing caseloads.

However, despite the right to an attorney being a fundamental part of due process, public defenders are unavailable in most municipal courts, and the Commission is not requesting the repeal of an existing budget proviso (61.12) preventing Commission funds from paying for appointed counsel in municipal courts.

The final example is the Department of Motor Vehicles (DMV). This agency was previously funded by the fines and fees it collected, but beginning with the 2017 bill authorizing new debt to fund road construction, lawmakers stripped most of those funds and funnelled them to the DOT for roads funding. As a result, the department is now primarily dependent on state appropriations.

The DMV is requesting a recurring General Fund increase of $9.8 million to address high employee turnover, stating that they are losing one-third of their employee base per year, and that due to high workload and understaffing, employees are not able to take their earned annual and sick leave. They are also requesting a one-time appropriation of $4 million to modernize their ancient software system.

***

The next step in the budget process is the Governor’s presentation of his executive budget, due five days after the legislative session begins. According to state law, lawmakers are then supposed to hold joint, open hearings on this budget within five days of receiving it.

Unfortunately, lawmakers refuse to follow this law, and develop their own budget in a plethora of unstreamed, unrecorded subcommittees. This nontransparent process centers key decision-making in the hands of a few powerful lawmakers, enabling the wasteful, corrupt spending that characterizes the South Carolina budget.